Will you sell 100 USD today if you stay completely sure that in two days USD will appreciate? Of course, not! The same way as any trader will do. Unluckily, traders are not prophets and no one can remain absolutely sure that this appreciation will really happen. Anyway, traders never rely on luck, applying as many tools as they can to get an outcome, which will happen with at least 60% probability. These tools may not stay easy for a beginner but as soon as they help you gain at least 6 successful deals, you will pay much more attention to results they give.

Economic and Statistical Tools for Forex Analysis

Technical and fundamental analyses remain the most popular ways to explain currency fluctuations in Forex market. The initial one tries to predict exchange rate on the basis of historical data and factors, having an impact on currency at the past while the latter one tries to predict how future events will affect currency behavior. They both employ a variety of economic and mathematical methods including:

1. Country’s economic strength: Economic theory states that countries’ exchange rates stay affected by state of balance of payments and country’s economic conditions, i.e. state of real GDP, level of unemployment, etc. For example, if you observe a GDP decline, you know that it will force the currency to depreciate so there is no reason to hold it now;

2. Purchasing Power Parity: the key assumption of PPP theory is that one asset should have the same price throughout all countries. So if some good is worth $4 in country A and $8 in country B (because of higher inflation), currency of country B will depreciate in order to lower “arbitrage opportunities”;

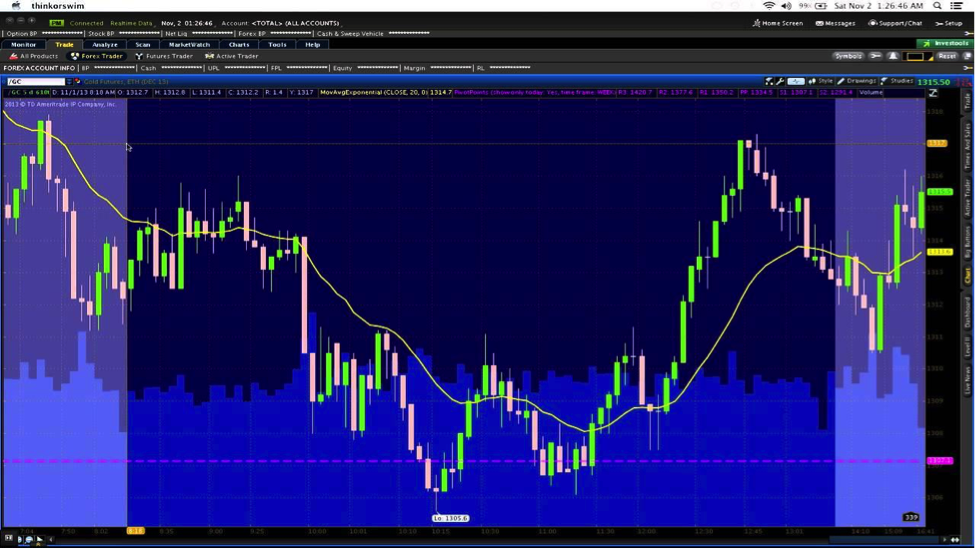

3. Using time-series modeling: With models based on time series, you have an opportunity to know how exchange rate today is related to exchange rate of the same currency tomorrow. Make historical data on Forex stationary and apply autoregressive, moving average, or ARIMA models, which will also give precise coefficients for prediction.

Are These Tools Enough for Precise Currency Forecasting?

If there were any ways to get future exchange rate with 100% precision, there will be no need for these 3 methods. The truth is that this world is unstable and we cannot be sure that in five minutes hurricane or an earthquake will not destroy entire country, devaluing its currency 7 times. We are not prophets and we will never know what will happen tomorrow so the best alternative for us is to assume that the same conditions remain and the exchange rate will go with the same trend as it was going many times before.

Anyway, all traders employ these tools successfully and not fail with forecasting dramatically.