The holidays is a hard time for us all, because we want to get our family members and loved ones the best Christmas presents possible. In other words, a lot of us go a bit crazy during the holidays. This is what happened to me. Honestly, I wasn’t being as careful as I should have been with our budget. Once I started spending money I encountered a snowball effect. It was almost like I just couldn’t stop. I was having too good of a time. Has this ever happened to you before? I hope I’m not alone.

The holidays is a hard time for us all, because we want to get our family members and loved ones the best Christmas presents possible. In other words, a lot of us go a bit crazy during the holidays. This is what happened to me. Honestly, I wasn’t being as careful as I should have been with our budget. Once I started spending money I encountered a snowball effect. It was almost like I just couldn’t stop. I was having too good of a time. Has this ever happened to you before? I hope I’m not alone.

Now that the holidays are over, a lot of people are still in debt and trying to get their budget back on the rails. I’ve been down this path before, so I know exactly what to do to get my budget back on track and I’m going to share my experience with you.

#1. Stop Spending Money

Once you’re on a roll, you’ll find it very difficult to stop spending money. It’s almost like it’s addicting and it can be really hard to stop. Stop spending money immediately and do whatever it takes to resist the temptation of spending money.

#2. Use Coupons

This site is littered with some of the best coupons on the hottest products. In other words, you need to start using our website to your advantage. If you haven’t started couponing yet, you should really consider starting right now. With the help of coupons, you could save hundreds or even thousands of dollars a month on groceries. You could use the money you’re saving by couponing to pay on your credit cards bills and what not.

Coupons aren’t only limited to groceries, either. We have tons of coupons on our site that will help you save money on household items, electronics, groceries and everything you could possibly imagine. We make it our mission to find and post the best coupons for you to use, so you save as much money as possible.

#3. Donate Items for Tax Write-Offs

Chances are you have a ton of stuff around your house that you don’t need anymore. For instance, you probably have a lot of kid’s clothes that don’t fit anymore. You can take these clothes to stores, such as Goodwill, and donate them to the store for tax write-off slips. Also, you’ll be helping other mothers in your area by doing this.

#4. Host a Yard Sale or Garage Sale

If you want cash instead of tax write-offs, you could always host a yard sale. Put up a sign and get cash for stuff you don’t need or want anymore.

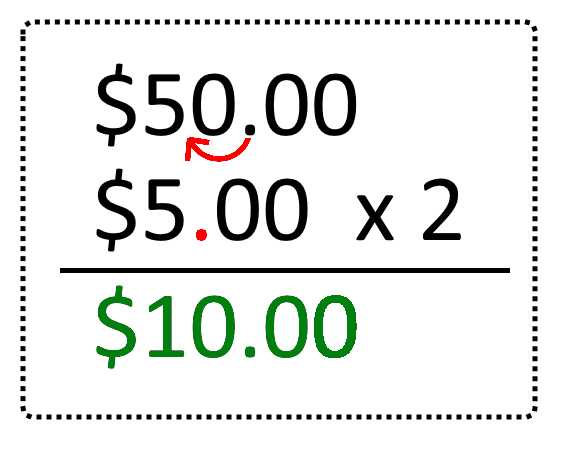

#5. Make a Budget

If you’re in some serious debt you may want to make a budget, so you can see exactly what you’re spending money on. After you’ve figured out where all your cash is going, you should sit down with your husband and make up a budget to stick to. That way, you both know what you’re working towards and you’ll help each other stay within your budget.