I would lie if I said the latest financial news have not been on my mind. They have been occupying my thoughts a lot actually. I was feeling helpless until I realized there are a few things I can do to manage the impact of an economic downturn.

Control Spending Habits

Spending less may seem like a no-brainer. However, I think that many people fail to grasp the seriousness of the situation and continue with their habitual spending levels. This is the time to spend less, control impulse buying and forget about using credit cards.

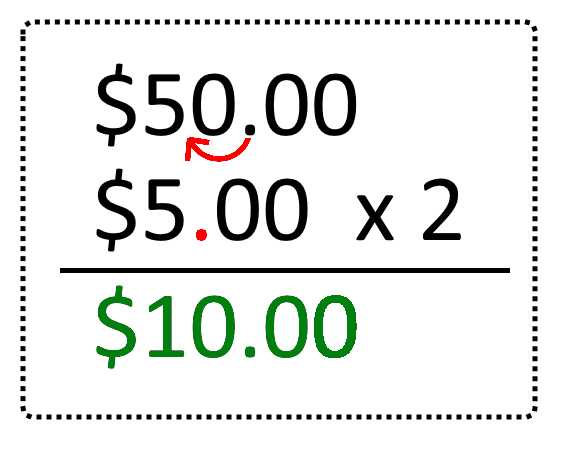

Improve Shopping Skills

You need to make the money you already have last longer. This is the time to use coupons, shop around your grocery store’s sales circular, stockpile loss leaders and play the Drugstore Game among other things. If you are reading this blog then you probably are already doing some of this things. Keep working hard to stretch your dollars.

Create More of What You Need

Consider creating a secondary stream of income. This goes beyond getting a second job. There are other ways to generate more income: monetize a hobby or turn some of your clutter into cash. Resourcefulness and creativeness are essential for this.

Save More

If you have many more years to go until retirement this is the time when dollar-cost averaging pays for you. If retirement is looming closer though, unfortunately you will need to make up your losses.

It is times like these that prove to me that being frugal is a skill worth having. Frugality teaches us to live better with less and use efficiently the resources that we already have. Don’t let fear paralyze you, it is time to act and work on lessening the impact of what’s going on. Are you taking any steps to minimize what’s ahead?