I recently read that less than 40% of Americans have enough money on hand to cover a $1,000 emergency. We all know how important it is to have an emergency fund in place, right? It can truly be the difference in going bankrupt or not. Do you have an emergency fund set up yet? If you said no, that’s OKAY! It’s not too late to get your fun up and going. We are going to go over some tips for saving for an emergency fund, so you can be a part of that 40% that is ready to go in case of emergency!

Here are some tips for saving an emergency fund that you can start implementing now:

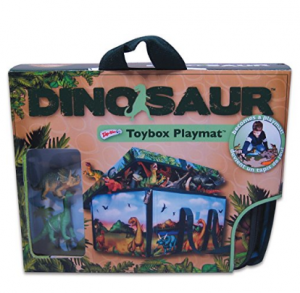

- Clean out those closets. Many of us have at least $1000 worth of stuff just hanging out in our house that can be sold. Use this money to fund your emergency fund! This can be toys that your kids no longer use, clothing that you no longer wear, tools that are unneeded, electronics, etc. The list goes on and on and can add up to more than you think.

- Get rid of unused memberships. Lots of us are busy paying bills on things we rarely use anyway. I try to stay on top of my budget pretty religiously, but I just discovered that I forgot to cancel a trial membership and have since been charge $29.95 for it. Do you have any of those charges happening. Or, do you pay for a gym membership you don’t use?

- Cut cable. Yes, I know we talk about this all the time, but it’s true. You can pay a fraction of what you pay for cable to stream TV. We went from $100 per month down to less than $30 (Including Amazon Prime) and haven’t looked back. My kids haven’t complained about lack of TV either.

Do you have an emergency fund in place? Did you use any tricks to fund it?